In a previous post I asked “Why are Rents (and Home Prices) so Damn High?” and described four candidate explanations. These explanations are actually packages of answers to several questions with an associated vibe and general ideology. I promised I would work through these clusters and sort it all out.

This post is going to offer some evidence against #4, the NIMBY Demand-Sider, from my home province of BC: the Foreign Buyer Tax data. This is old news for any grizzled observers of the BC housing market, but still new and interesting to me and maybe others. Most economists are not very sympathetic with the NIMBY Demand-Siders, so afterwards I’ll try to Steelman them.

Foreign Buyer Tax Data

In 2016 the BC government introduced the ‘Foreign Buyer’s Tax’. The tax is 20% on the share that a foreigner invested in a residential property, if the investment is in certain regions of BC. One good thing about this tax is that it gave us data that didn’t exist before, which helps us understand the problem. It’s ironic that the data needed to make an informed policy decision often arrives as a result of having already made the decision, passed the law, and hired the bureaucrats—one of the contradictions and impossibilities of being “data-driven”. Now that we have it, being tax data, we can take it pretty seriously as far as I know; taxpayers are probably loath to deceive, lest they suffer the fate of Al Capone.

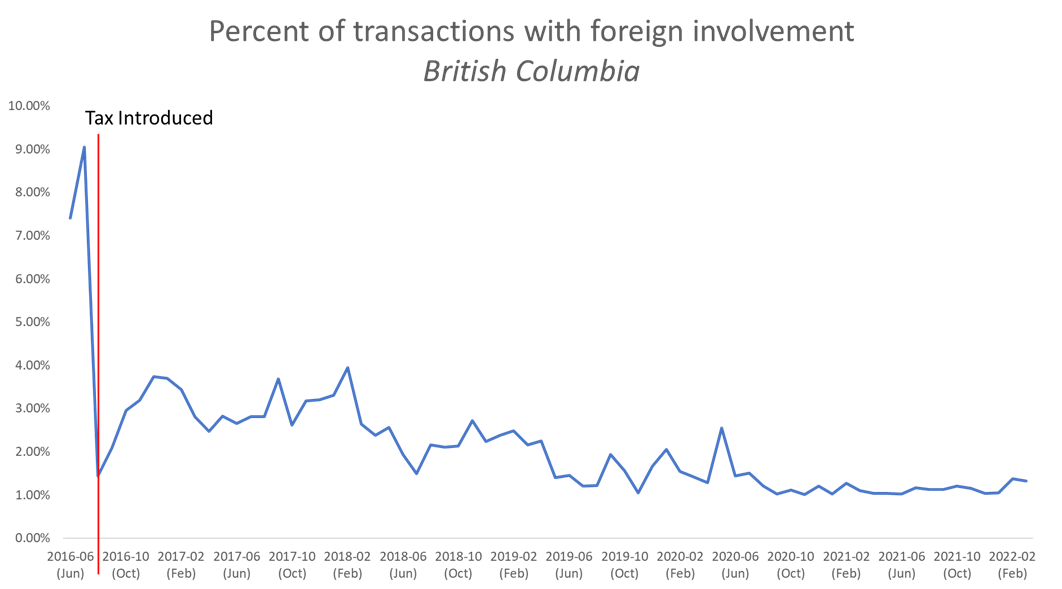

In the areas where the tax applies in the province (most of it), we can add up all transactions that had a declared foreigner involved in the transaction and divide by total transactions. That is graphed here:

We see a few things immediately.

1) The percent of foreign-involved transactions is currently just over 1%.

2) This proportion has declined over time.

3) The proportion was very high in the two months right before the tax was implemented, but we don’t know the level prior to that.

What can be made of this? Again, it’s too bad we don’t have this data historically so we can know what the proportion was before the tax. Probably the 2 months right before the tax was implemented was biased dramatically upwards as people tried to buy in before the tax applied. Impossible to know for sure, but a reasonable guess is that before the tax the average proportion of transactions involving foreigners was, say, 5%.

Why has it declined over time? Is the tax annoying foreigners more and more, encouraging them to look elsewhere? Are foreigners funneling money in ways that avoid the tax? I don’t have a good understanding of how easily foreigners can avoid the tax by simply having a resident (or resident corporation?) buy the property on their behalf. Is this even a problem? I thought immigration and FDI were desirable? Maybe not to the NIMBY Demand-Sider.

We also know that sales in British Columbia fell sharply right after the tax was implemented. Seasonally adjusted sales fell 19% in August 2016 and remained below normal for a while. This, combined with the large spike prior to the implementation, suggests that foreign buyers did matter to the market. This aligns with intuition and anecdote. However, sales recovered to normal levels soon after. We don’t know the counterfactual, but any effects today aren’t visible to the naked eye.

To summarize, it does look to me like the tax achieved its policy objectives, if those objectives were to reduce foreign demand for real estate and foreign money in the market. This is achieved by either the direct cost of the 20% tax or the added annoyance and inconvenience of evading the tax. Reasons I think the tax “worked” at reducing foreign demand are the big spike in transactions right before the implementation, the weak sales immediately following, and the general downward trend in (measured) foreign transactions ever since. Nothing here is dispositive.

However, even if we grant the Foreign Buyer’s Tax this victory, if we are interested in the big picture of Why are Rents (and Home Prices) so Damn High, it is unsatisfying. Amid declining foreign transactions (as measured), prices and rents have marched ever higher. Nowadays it just doesn’t seem like the Foreign Buyer’s Tax is that consequential.

Is this even the argument?

Am I being fair to the NIMBY Demand-Siders? This might be one of those situations where we have a surface level argument which is entirely within the Overton Window and wrong but connected by invisible string to another argument which contains some of the truth but is unspeakable in polite company. Many such cases.

According to the law, “foreign buyers” are people (or corporations) who are not residents of Canada. To tax foreign buyers then is to tax non-residents of Canada who buy property in BC. But maybe NIMBY Demand-Siders are just talking about all immigration. Maybe the theory is that immigration, and the money that both resident and non-resident immigrants bring, are responsible for rents and home prices being so damn high. This immediately sounds more plausible but also more politically fraught.

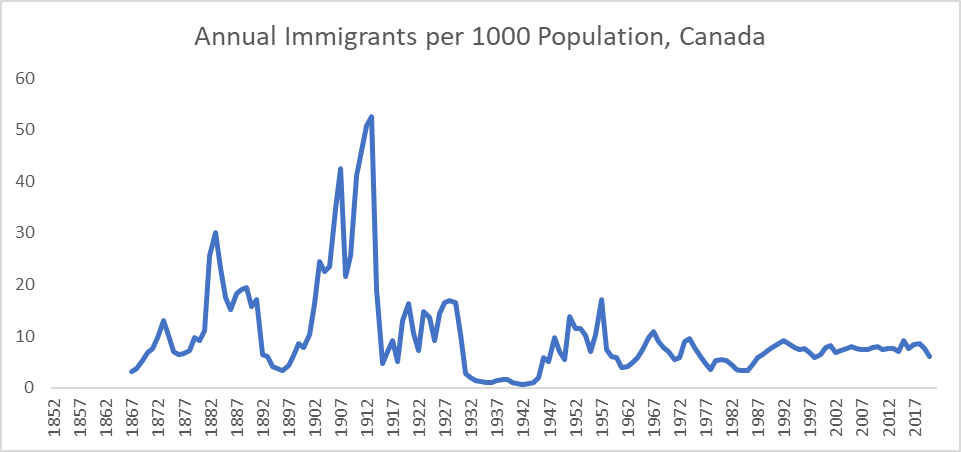

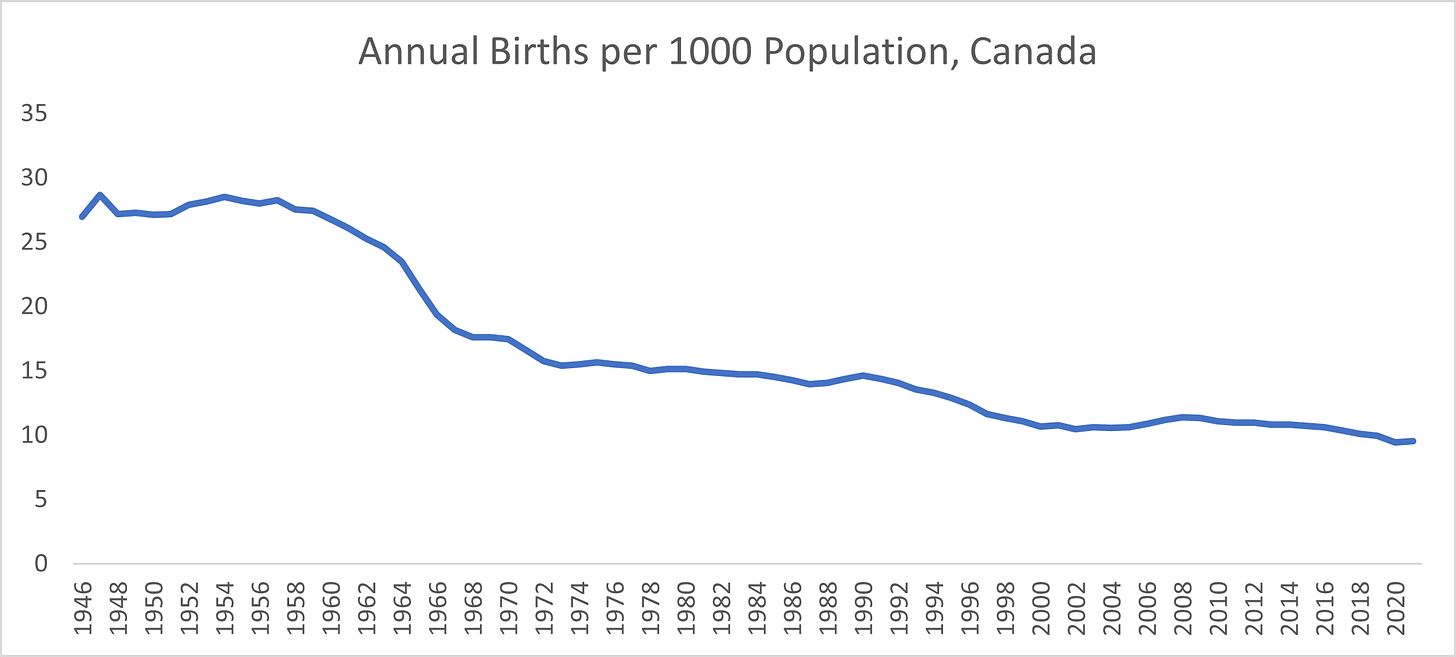

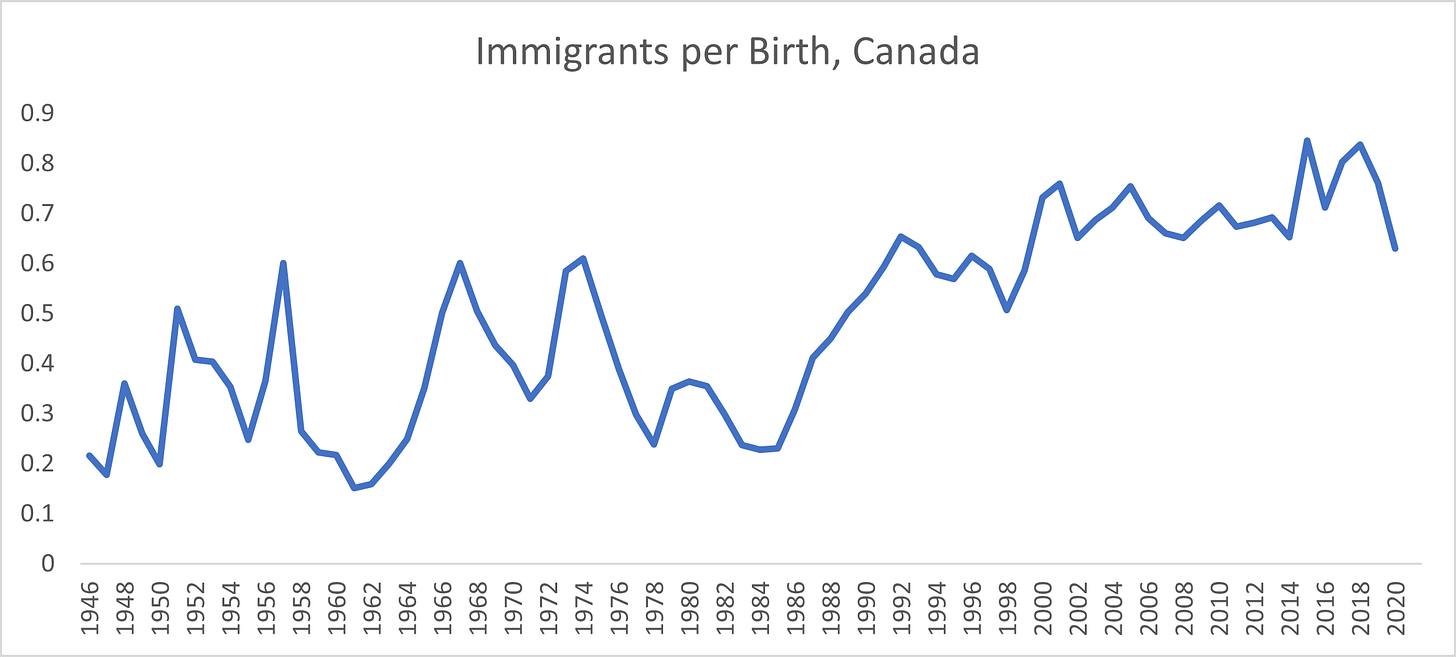

It's harder to make this case than you might think. First, perhaps surprisingly, immigration is not historically elevated on a per capita basis. It’s been pretty steady for a few decades.

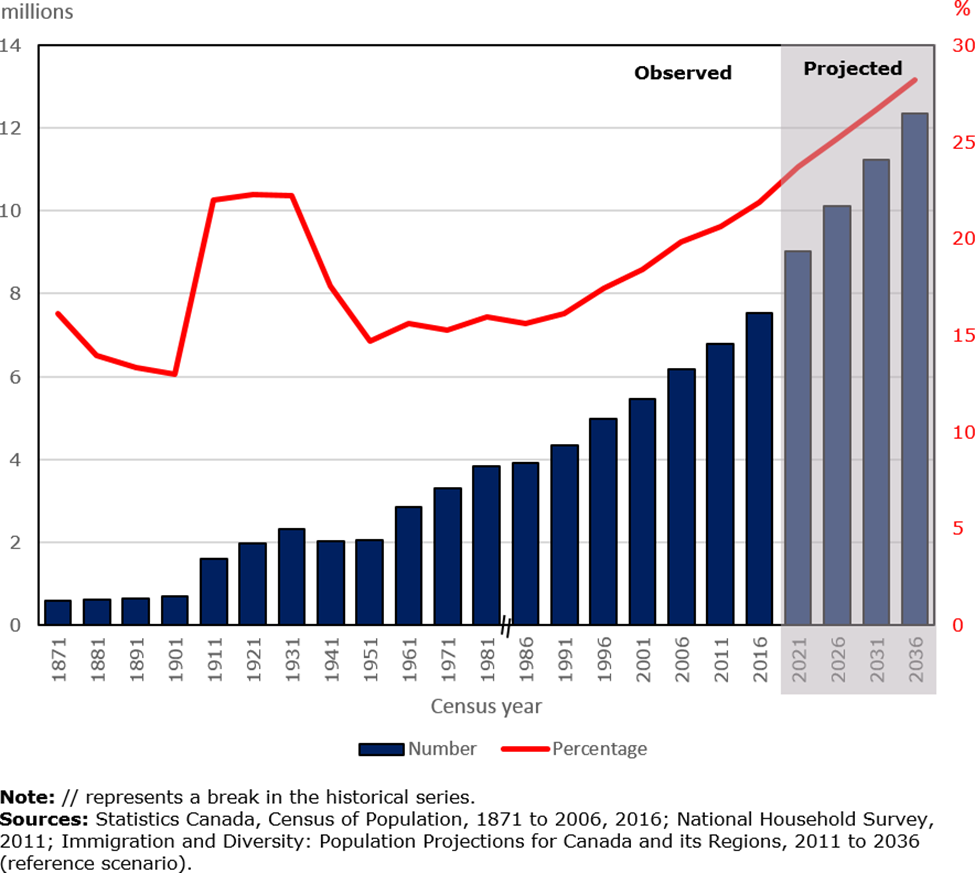

So, if immigration on a per capita basis is not historically high (not even close to the levels of the early 1900s) why is the share of foreign-born Canadians at the highest level ever recorded and projected to keep rising?

It turns out that the anomalous aspect of current Canadian demographics is not unusually high immigration but unusually low birth rates. If Canadians were reproducing at historically typical levels, current immigration would not result in such a large increase in the foreign-born population.

In fact, immigrants per birth is getting close to 1:1. At this level, the long-run equilibrium foreign-born share is about 50%, compared to something like 23% today.

It’s not clear from this that immigration is responsible for the takeoff in prices. Especially since prices exploded during COVID, when borders and immigration were largely shut off.

Maybe immigrants have a lot more money to spend on housing than locals, so a rising share of foreigners in society is radically increasing demand for housing. The Canadian Housing Statistics Program found that foreign-owned properties tended to have higher values (37% higher median single family home value compared to resident-owned in BC). The CHSP found 6.2% of BC properties had at least one non-resident owner (I think this doesn’t contradict the Foreign Buyer tax data since CHSP measures stock and the tax data measures flows).

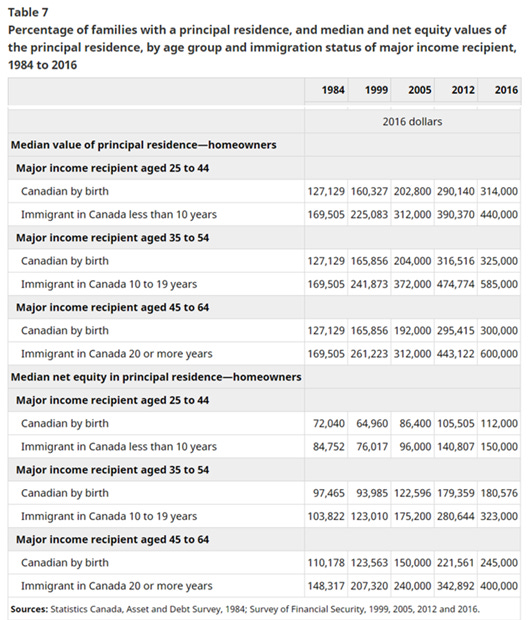

Other data suggest immigrants put a greater proportion of their wealth in housing than native-born Canadians and have larger mortgages. Controlling for the age differences between Canadian-born and immigrant families, average household wealth are similar between the two groups, with young immigrants doing slightly worse than young native-born, and older immigrants doing slightly better than older native born. However, immigrants do put a lot more of their wealth into housing relative to the native born. This could mean a greater proportion of foreign-born in society are partly responsible for the rising proportion of wealth and income devoted to housing.

This is the best I can do right now to Steelman the NIMBY Demand-Siders and it is far from a slam dunk. As I keep looking, I might find other stuff which supports or undermines their case. So far it does look like immigrants prefer spending on housing relative to the native-born. But I’m still not seeing anything which strongly shows that immigration is the primary cause of the big run-up in housing prices over the past few decades. And certainly the experience during COVID has poured cold water on this theory, since immigration was shut off precisely when prices rose very quickly.

More to come.